…so they want more. And more. And….

President Biden made a renewed push on Monday to galvanize congressional Democrats to overhaul the nation’s tax code and dramatically raise rates on corporations and ultra-wealthy Americans.

… Under his proposal, taxes would rise by $2.5 trillion….

And

The higher taxes would largely be borne by Wall Street and the top sliver of US households, in the form of a steeper corporate rate, a modified wealth tax….

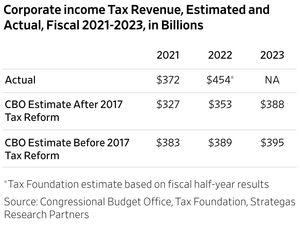

That raised corporate tax rate is, in part, a withdrawal of the corporate tax cuts of the Trump administration, a reduction that made our companies globally competitive and brought their investments back home as well as encouraged increased foreign company investment in our nation. It’s also a net increase in rates over what existed prior to the Trump cuts.

That wealth tax includes a

minimum 20% tax on the incomes of US households worth $100 million or more

along with a tax on unrealized capital gains—that’s the “worth more” part. Those unrealized gains aren’t even income, either, since the assets experiencing the growth isn’t income.

Withdrawing all that money from the private economy is money that won’t be, can’t be, committed to R&D, other innovation, production facility improvement, production facility construction, wage and benefit increases for employees, job creation for additional employees, and on and on and on.

President Joe Biden (D) said his budget demands ensure that

corporations and the very wealthy pay their fair share.

Pay our fair share? What, I ask, is our fair share? Biden and his Progressive-Democrat cronies answer, “All that you have.”

Even one of the founders of the modern Progressive Movement, TR Roosevelt, might demur from this bit of confiscation:

Our country, this great Republic, means nothing unless it means the triumph…in the long run, of an economic system under which each man shall be guaranteed the opportunity to show the best that there is in him.

That is the essence of the American Dream, but Biden-Harris and his cronies want to cap our Dream and punish us American citizens for being successful.