There’s this bit from Power Line:

And this quote from Severin Borenstein’ and Lucas Davis’ The Distributional Effects of U.S. Tax Credits for Heat Pumps, Solar Panels, and Electric Vehicles:

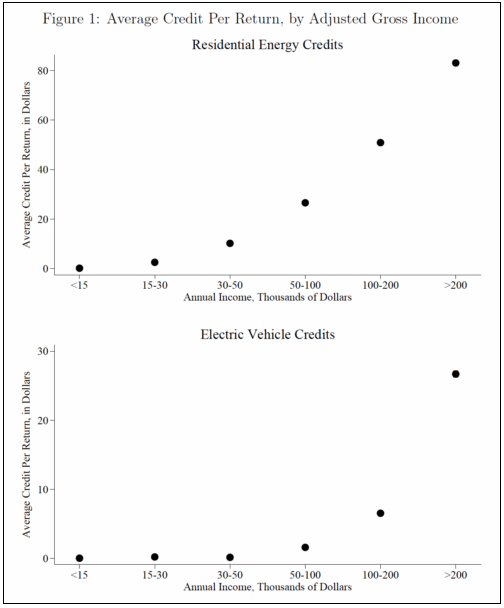

Over the last two decades, US households have received $47 billion in tax credits for buying heat pumps, solar panels, electric vehicles, and other “clean energy” technologies. Using information from tax returns, we show that these tax credits have gone predominantly to higher-income households. The bottom three income quintiles have received about 10% of all credits, while the top quintile has received about 60%.

It’s reasonable to ask why those “bottom” quintiles—which include the middle-class folks—don’t buy more of these cool green devices. The answer is because even after the lavish subsidies, they can’t afford the devices. The remaining, out of pocket, costs still are too great. Worse, those remaining out of pocket costs comprise the entirety of the costs for much of the bottom two quintiles:

About 40% of US households pay no federal income tax, so millions of mostly low- and middle-income filers are simply ineligible for these credits.

It’s also reasonable to wonder whether Government is simply subsidizing a market until the devices become ubiquitous enough for prices to come down. Leave aside the fact that subsidies vanishingly rarely go away and protected industries just as vanishingly rarely lose their “protection.” The plain fact here is that, after all these years of pushing the devices, and even after all these years of real improvements in their performance, there is no interest in these devices across the broad market. It’s an industry that’s not going to take off without ever larger subsidies, ever increasing government pressure on us to get these devices anyway, ever increasing effort government effort to deny us access to alternative devices.

These green subsidies just give the already rich liberal Left a way to look good to each other in their solar-heated showers.

Maybe it’s time to start making the supporters of Green Politics pay their fair share.

H/t Ralf Longwalker