It’s been almost entirely missed by Progressive-Democrats and almost entirely ignored by the Left and its NLMSM.

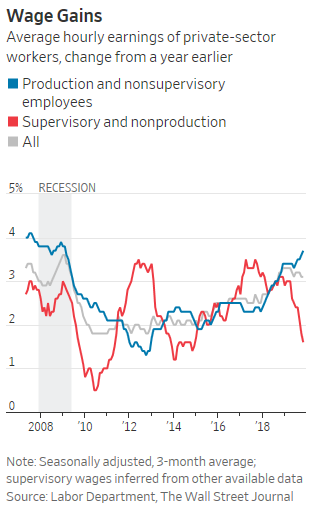

Rank-and-file workers are getting bigger raises this year—at least in percentage terms—than bosses.

Wages for the typical worker—nonsupervisory employees who account for 82% of the workforce—are rising at the fastest rate in more than a decade, a sign that the labor market has tightened sufficiently to convey bigger pay increases to lower-paid employees.

Of course, it’s understandable that Progressive-Democrats have missed this. They’ve trained their fire on the Evil Rich and demands that those folks should give up their wealth for redistribution to the…middle class. All along, Progressive-Democrats have ignored the bottom of the employed and want-to-be-employed spectrum. Other than, of course, those worthies’ virtue-signaling and anti-employment minimum wage increase demands.

It’s also understandable that the Left and its NLMSM have done their best to ignore this wage increase development. After all, it comes on the heels of the slowest post-recession (let alone post-Panic) reemployment development since WWII, and it comes so quickly after wages for the typical worker stagnated, and real wages actually declined, during the Obama administration’s post-Panic pseudo-recovery.

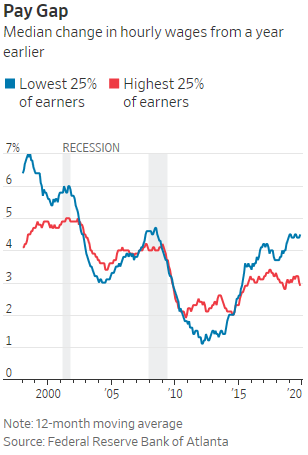

Progressive-Democrats also want to talk about the evils of income inequality, while carefully ignoring the opportunity inequalities that would result—have resulted—from their policies. See, for instance, the results of their mandated minimum wages: net lower income for those still employed low-skill workers and the lower employment rates in thin-margin businesses, second-job family seekers, teenagers looking for their first jobs. Here are a couple of graphs depicting income inequality.

How terrible are these inequalities?

How terrible are these inequalities?