Twitter has applied a US state-affiliated media label to National Public Radio‘s Twitter account. Twitter’s label defines such media as

outlets where the state exercises control over editorial content through financial resources, direct or indirect political pressures, and/or control over production and distribution[.]

What interests me, though, aside from the fact that there is a measure of affiliation just from the fact that the Federal government provides some funding to NPR, is the reaction to the label by NPR‘s CEO John Lansing in his statement—which he posted on Twitter:

NPR and our Member stations are supported by millions of listeners who depend on us for the independent, fact-based journalism we provide[.]

This is mostly irrelevant to whether NPR is state-affiliated. Voice of America, for instance, also is state-affiliated, and it provides fact-based journalism to the world—along with a strong measure of state-provided propaganda.

Mostly irrelevant: there’s this claim from NPR‘s Web site [emphasis in the original]:

Federal funding is essential to public radio’s service to the American public and its continuation is critical for both stations and program producers, including NPR.

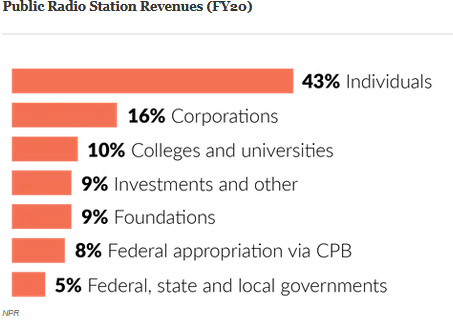

And yet, just above that claim is this graph delineating NPR‘s funding sources as recently as its2020 fiscal year:

Plainly, NPR‘s support does come primarily from Lansing’s millions of listeners. Only 8%, plus a taste, of his funding comes from the Feds. That level may well be important, but it’s far from essential.

Lansing can’t even keep his stories consistent with each other. Which makes his objection even more irrelevant, both on substance and on the funding question.

Even so, that funding gives the Federal government that measure of influence over NPR‘s editorial decisions. And there’s the Federal government’s empirical use of its power to pressure Facebook’s Meta’s and pre-Trump Twitter’s editorial decisions. State-affiliated is warranted.

Sort of aside: it seems likely to this poor, dumb Texan that those State and local governments listed in the graph above, being much closer to Lansing’s millions of listeners than the Federal government, could well fill any shortfall were the Federal government to reduce or eliminate its funding share. That is, if the listeners resident in any of those more localized jurisdictions agreed that NPR was worth their tax money.

Update: As of 12 April, NPR has decided to no longer actively maintain its flagship @NPR Twitter account or any other official NPR accounts on Twitter over the site’s attaching the state-affiliated media label to its posts.

Buh by, luv ya, mean it. Watch out for that door closing behind you.