President Joe Biden (D) has killed the Keystone XL Pipeline, is blocking oil production from Federal lands, killed oil production in northern Alaska, is working to kill fracking altogether, is working to kill American oil (and natural gas) production, and has given the go ahead to Russia’s Nord Stream 2 pipeline. In sum, he’s actively working to kill American energy independence.

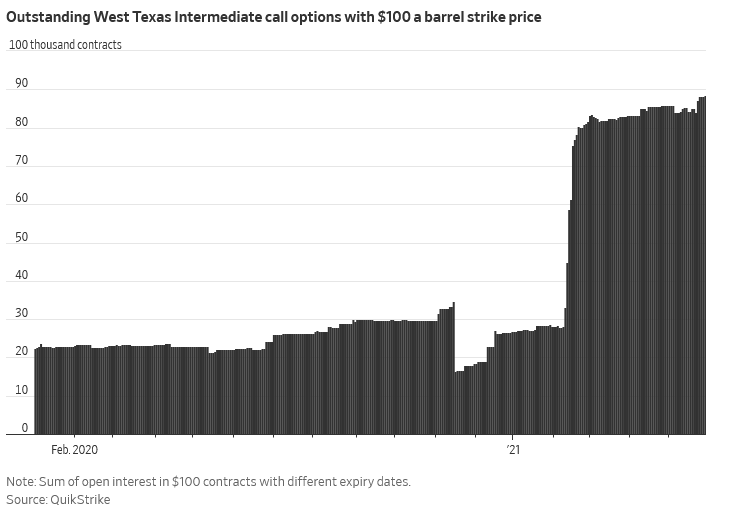

All of that is driving up American citizens’ energy costs, and that is reflected in the market’s anticipation of spiking oil costs. Here are a couple of graphs illustrating that. They illustrate the expectation that oil will soon cost $100/barrel, after several years of $50-$65/barrel. The first presents the spike since the start of the year in the number of West Texas Intermediate $100/barrel futures contracts against a current $70 price.

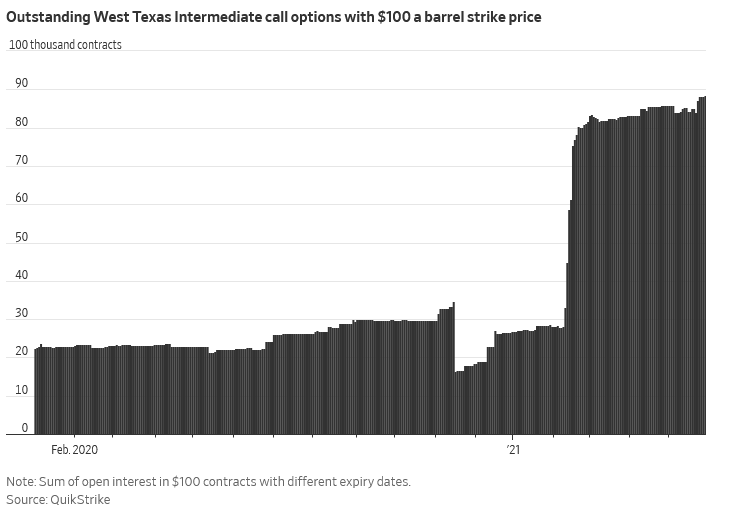

This graph reflects the price of a $100/barrel call option on WTI for delivery in December this year and next.

The expectation of actual market pricing of $100 is rising, also, sharply enough to drive up the price of the option.

This is what expert traders (some of whom are trading on the trends themselves and not on underlying oil prices, to be sure) are seeing as the future price of oil for our citizens. Even if oil settles out at its current price of $70 or just a little higher (and the anticipations turn out to be overstated), this current price represents a sharp increase over the last several years, when Government wasn’t moving so zealously to restrict our nation’s oil supply.

This is what Biden has wrought for our nation’s energy supply and cost of energy.