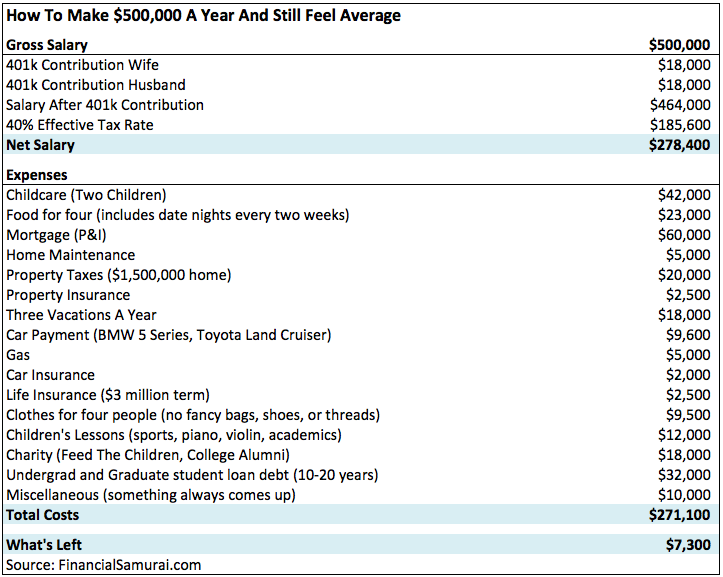

Some folks think an annual income of a half million dollars leaves them…average…and strapped. The tweeted image of an example of this delusion is below. CNBC represents this as a real couple.

You can read the CNBC article linked to in the tweet here, but the image and many of the comments in the tweet’s thread are instructive by themselves.

Morgan Housel offered a couple:

@morganhousel

So $36K in 401k contributions should be added to “what’s left over,” along with $18K in charity contributions (not an expense either).@morganhousel

If you fix that then the headline becomes “This couple that makes $500K and spends too much money still saves more than 20% of their after-tax salary, which is what happens when you make a lot of money.”

Here’s ODS:

@brendan_schleen

Average people don’t have the ability to contribute 18k a year to charity either

KP:

@lightsoutonight

Their house is $1.5 million, with $20,000 property tax payment. So average.

m night…:

@HezbollottaLove

Personally I love to be so goddamn deluded that I can save $36k a year for retirement, have a $200/month per person clothing budget, and spend $2000/month on food, and STILL have $7300 leftover as Do Whatever money, and think that’s “average”

And Thomas:

@MintyMultimedia

3 6k vacations a year, 12k a year for “lessons” even though the kids are young enough to need 42k a year in childcare.

The dude who deluded himself into thinking this was “average” was high off his own farts.

In the end, though, go ahead and read the linked-to article. Its author, Kathleen Elkins, shows herself to be delusional with remarks like these:

As the example of one New York City couple shows, you and your partner could be making $500,000 a year and still end up with very little besides 401(k) money.

And

…there’s only $7,300 left each year to go towards other savings goals, investment accounts, or retirement funds.

Very little. Those 401(k)s getting 36 stacks per year aren’t actually retirement funds, apparently. And the $7,300 that’s left over is just dog food. Never mind that lots of actually average income households would love to have that much at the end of the year to go towards other savings goals, investment accounts….

h/t to ralf.