Former President Donald Trump (R) paid breathtakingly little Federal taxes compared to his wealth over the six years covered by his tax records, which the Progressive-Democrats so dishonestly, if strictly legally, released. And yet, despite those same Progressive-Democrats’ desperation to expose illegalities in his low tax payments, those same records prove he did nothing illegal; he simply took advantage of what our tax code—as enacted over the years by both parties as they held sway—plainly, and by design, allows.

Think that’s unfair compared to you and me? Think it’s not right that rich folks should have access to…loopholes…that us average Americans can’t reach?

Nah. For all the imbalance, there’s nothing unfair about it. The opportunities are right there in plain sight in our byzantine body of tax law. And they become increasingly accessible to us as we rise up our nation’s economic ladder.

Still the imbalance should be corrected, and that’s easy to do. Nor does it involve increasing taxes on the rich, although it does involve closing those…loopholes.

All it takes is two things.

First, we get rid of our existing income tax code, every jot and tittle of it.

Then we replace it with a new income tax code. That new code would eliminate entirely business income taxes—not merely zero out the maximum rate, eliminate that tax altogether. If it’s still on the books, it’s too easy to raise the rate later, even from zero.

Businesses don’t pay a significant portion of that tax, anyway; their customers do in the form of higher prices, and the rest of us do in the form of reduced rates of business growth, hiring, and wage increases—with the resulting reduced productivity—and in reduced rate of innovation.

With the elimination of the business income tax, businesses would be able to raise capital, grow, innovate, produce—make business decisions—based solely on the economic wisdom of the decisions. Having to dance around the tax code, having decisions influenced by tax advantage or disadvantage would be a thing of the past.

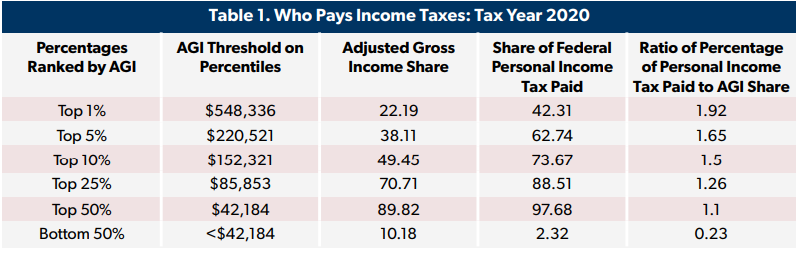

The new income tax code would include a low (10% perhaps) flat tax on all personal income regardless of source, and the code would have no subsidies, deductions, credits, what-have-you. No loopholes. Just: enumerate your income, remit 10% of that.

Now us Americans would be able to keep more of our money, make freer decisions concerning our needs and wants, have more to save for emergencies, future expenses, retirement. All based on our own view of our present and future economic situation, instead of having to do our own dance around the tax code.

Too, with everyone paying at least a little, the Federal government would see a net increase in tax revenue, and that increase would be even larger from the increased overall economic activity in a free market economy in which the private players, us Americans and our businesses, are more active.

Easy peasy. All it takes is political courage. And for us American voters to inject that courage by repeatedly firing those politicians who lack it and repeatedly hiring those who have it. After all, that’s what elections are for—they really do have consequences.