This is what Progressive-Democrat President Joe Biden’s proudly touted Bidenomics has inflicted on us: continued high inflation.

Tacitly, Biden knows his policies are a failure, but he won’t admit it.

For now, officials said, Biden and his senior aides aren’t planning any major policy or rhetorical shifts.

Yet,

Behind the scenes, administration officials said there was no magic bullet to slow rising prices immediately, an issue that has dogged the president for years.

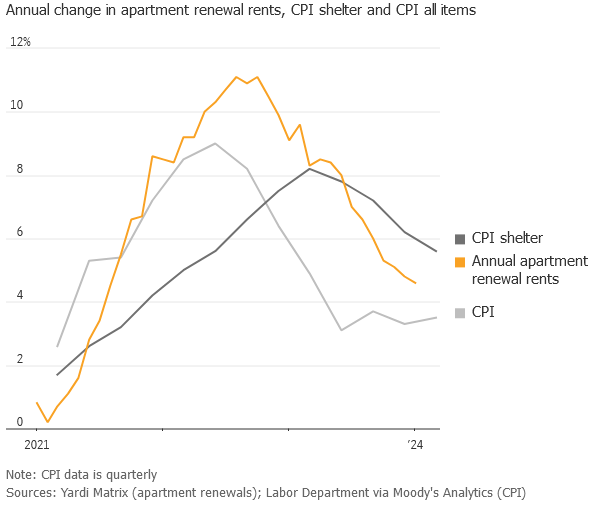

Rising prices—inflation—has been Biden’s problem since he took office; that’s the time frame of that drily put “for years.” From the Biden-caused sharp increase that damaged so many millions of pocketbooks of us ordinary Americans through that partial fall in inflation, of which Biden is so, and so misleadingly, proud, to the last few months of steadier 3+% inflation, we’re still facing price levels increasing at much higher rates than before Biden began his reign.

Some of Biden’s cost-cutting plans will take months to come to fruition and will do little in the short term to slow the rate of price increases.

[T]ake months to come to fruition: yeah—they’ve taken three years and counting.

Some stubbornly high prices, such as the cost of groceries, are mostly out of the Biden administration’s control.

Here, the news personalities who wrote the article at the link are badly mistaken. All of those high prices are fully under the administration’s control. Begin with Biden’s war of destruction on our energy industry. Energy underlies every aspect of our economy: fuel for our personal vehicles, energy to heat our homes in winter and cool them in summer, fuel for generating the electricity that’s needed in every aspect of our personal and business lives, shipping costs for all of our goods and services—including shipment of our groceries—and on and on. By seeking to destroy our coal-, oil-, and natural gas-based energy production, and continuing to passively block development and construction of nuclear power plants, Biden is raising the prices of energy, and that alone raises the price of every single item in our economy. Including those groceries.

Most economists don’t believe Biden can do much at this point to bring down inflation, absent major tax increases or spending cuts that could curtail consumer spending. Even those policies, which aren’t being seriously considered in Washington, would take time to work their way through the economy.

Most economists are right as far as they go. And they’re wrong. Tax increases or government spending cuts would take time to have effect. However, tax increases would reduce economic activity in general by taking even more money out of our private economy than our usurious current tax code does. That reduced economic activity will only lead to continued, if not increased, government spending in the form of welfare handouts, and those lead to greater deficits and debt, and to increased dependence on government.

Government spending cuts won’t, though, lead to less consumer spending. On the contrary, with less government competition for the same goods and services our private economy needs, inflation—and real price levels—would come down, making it easier for us consumers to consume, not harder.

But most economists don’t go far enough. There is much the Biden administration—Biden himself as President—can do that would have more immediate favorable effects on price levels. He can remove his Executive Orders that are interfering with the free flow of goods and services and that inhibit coal, oil, and natural gas production. He can instruct his Departments and Agencies to withdraw their rules that interfere with that free flow and that inhibit energy production.

But he won’t.