Progressive-President Joe Biden is busily trying to raise taxes in his never ending effort to get the Evil Rich to Pay Their Fair Share™.

Here are some numbers and a couple of graphs, via The Wall Street Journal‘s editors:

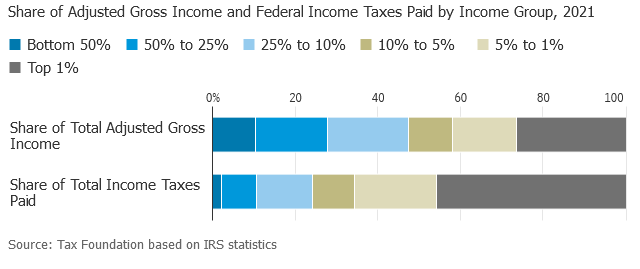

…for 2021 show that the top 1% of Americans reported 26.3% of the country’s adjusted gross income, while paying 45.8% of total income taxes.

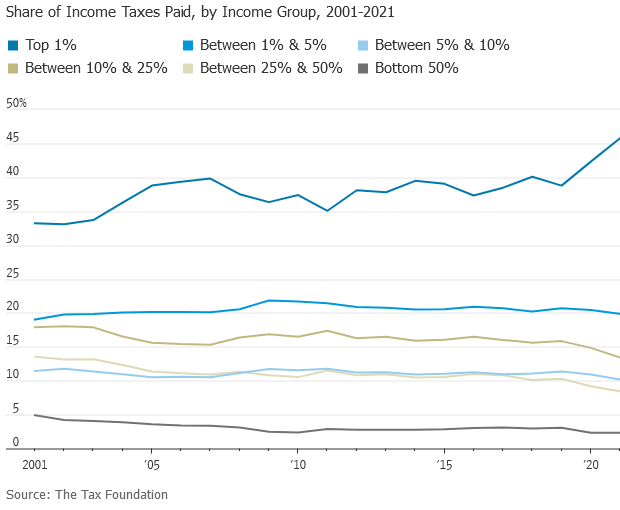

This graph shows the trend of taxes paid and who pays them over the course of this century:

This graph shows the trend of taxes paid and who pays them over the course of this century:

Yet Biden, Progressive-Democrat Senate Majority Leader Chuck Schumer (NY), Progressive-Democrat Senate Majority Whip Dick Durbin (IL), and the rest of Biden’s Party syndicate, individually and as a group, flat refuse to say what they believe that fair share should be. Plainly, that’s because they’ve already defined among themselves, that fair share to be All of It.

This is illustrated by the tax increases that Biden is actively pushing this year. Per a Tax Foundation analysis,

The tax increases would substantially increase marginal tax rates on investment, saving, and work, reducing economic output by 2.2% in the long run, wages by 1.6%, and employment by 788,000 full-time equivalent jobs. On a gross basis, we estimate Biden’s FY 2025 budget would increase taxes by about $4.4 trillion over that period [of 2024 to 2034]. After taking various credits into account, the increase would be about $3.4 trillion[.]

[Biden’s] tax changes…include “additional taxes on high earners, higher taxes on US businesses—including increasing taxes that Biden enacted with the Inflation Reduction Act (IRA) —and more tax credits for a variety of taxpayers and activities[.]

As the WSJ editors asked,

Is this not a “fair share” to Mr Biden? Then what would be?

Plainly what would be to Biden and his Party syndicate All of It.

This is the central plank of the Progressive-Democratic Party’s platform this season. And they won’t stop with the Evil Rich as they define down what constitutes “rich” behind their DEI smokescreen.