The Export-Import Bank’s charter is up for renewal in our Congress this spring. The bank is alleged to help American companies by lending money to foreign buyers of and American company’s products so that buyer can afford the purchase, which in turns helps the US company, and its employees.

That’s a pretty good deal, right?

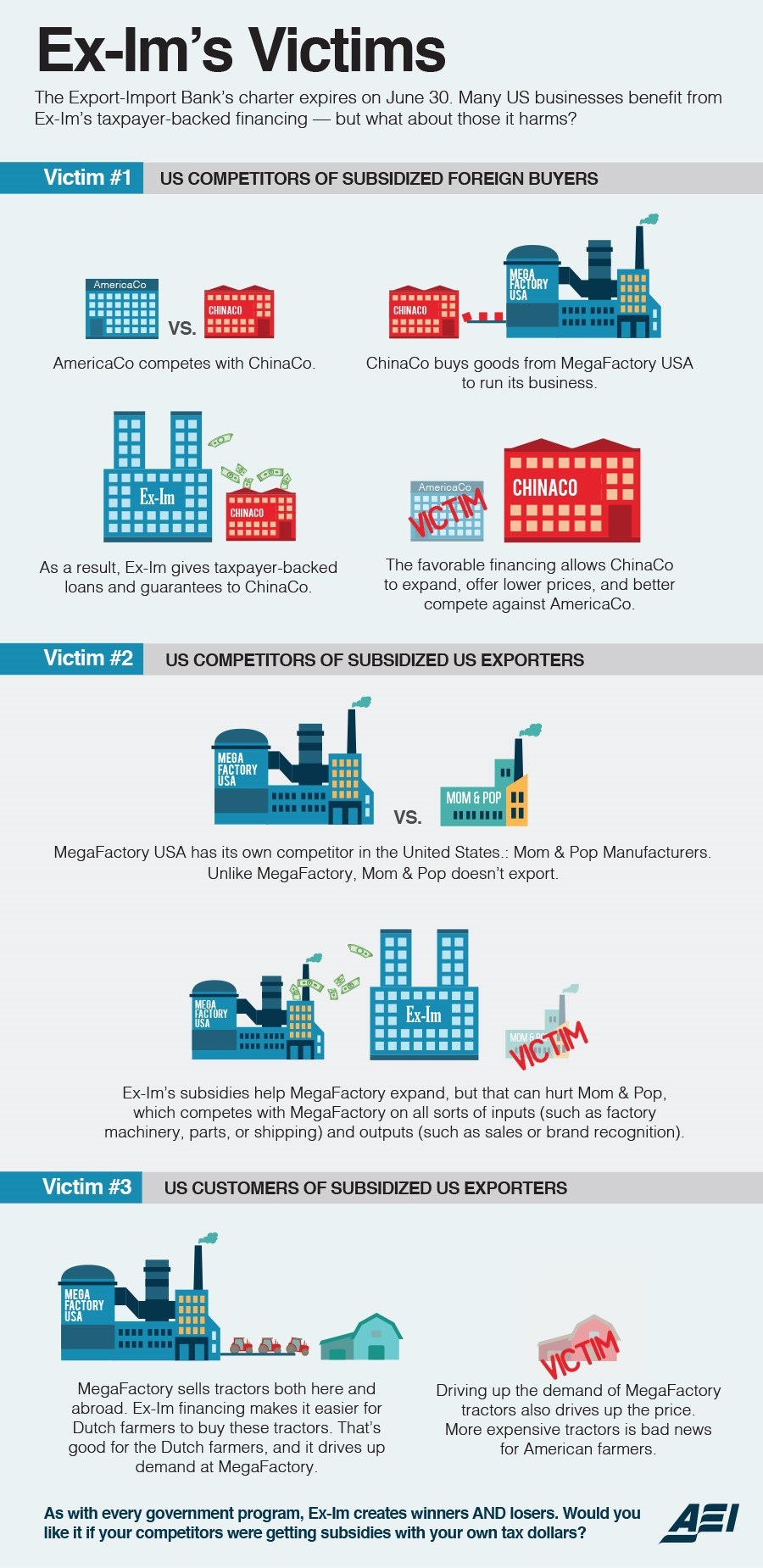

Maybe not so much. It’s American taxpayers who are on the hook—not just the one American company and its employees—if the foreign buyer defaults on the loan. But that’s not all. American companies trying to compete with that foreign buyer also are harmed, whether or not that foreign buyer defaults. See the graph below, from AEIdeas:

Don’t renew the bank’s charter.