The Congressional Budget Office is out with its projection for our nation’s economic future.

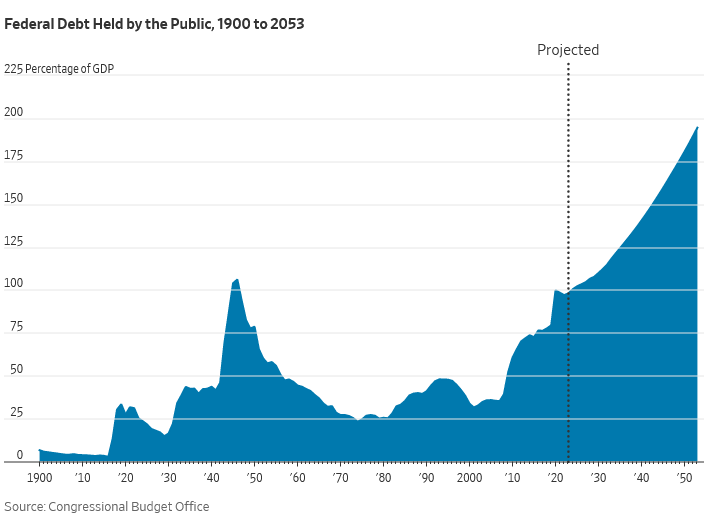

As for the much-discussed federal debt, the nearby chart shows how fast it has grown in the last several years. Debt held by the public—the kind we have to pay back to creditors like the Chinese and Japanese based on contracts—is now 97% of the economy, and will soon rise to 100% and keep going to 118.2% in 2033. How high can it go before creditors stop lending? No one knows, but it will be ugly if they do.

This illustrates the tight relationship between spending and debt limits, and why future spending cuts must be part of negotiations related to raising today’s debt ceiling limit. It’s barely possible to see any effect from the 2011 debt limit increase that was agreed in exchange for some “freezing” of Federal spending levels, a pseudo-freeze that in the end ended rather quickly.

There need to be real reductions in Federal spending, not just a reduction in spending growth or even a pretend freeze. There’s plenty of room in welfare spending, for instance, for cutting. Furthermore, all Federal spending is discretionary, the bad habit of calling some spending mandatory notwithstanding. Finally, to put a legitimate floor under spending (which doesn’t contradict the forgoing because it’s a floor not a mandatedly ever-increasing level), there’s a Constitutional requirement to spend adequately on national defense and debt repayment.

In the end, too, tax rate cuts, leaving more money in the hands of private economy actors—us average Americans and our businesses—leads to increases in Federal revenues. This has been empirically demonstrated by every tax rate cut since President John Fitzgerald Kennedy’s reduction of the top rate from the neighborhood of 90% to the region of 70%.

Federal spending cuts coupled with Federal tax rate cuts—they’re win-win for our economy and our nation, if only the Progressive-Democratic Party politicians in Congress and the White House would get out of the way.