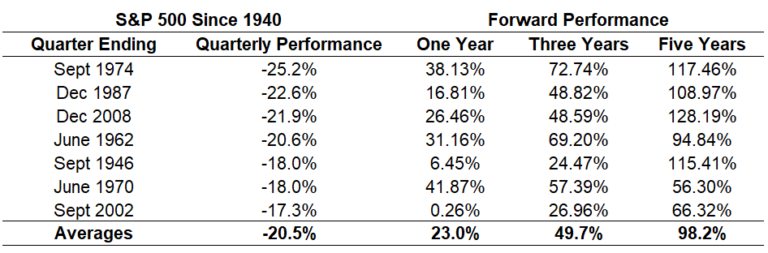

I’m not Alfred E Neuman, but I do have some history on my side. The current market situation seems ugly—and it is. Aside from my preferred stock portfolio, I’ve gone to cash equivalents for my investments. Here are some tables illustrating recoveries from past ugly market quarters, via Wall Street Journal‘s Market Watch column of, fittingly enough, Christmas Day.

Here we are without the Great Depression:

1932’s recovery isn’t here, but maybe that period was too high a price to pay for the recovery: 163%, 345%, these were from a severely lowered baseline.

Those are large capitalization stocks; here’s recovery for the Russell 2000, an index focused on small stocks:

For the just concluding quarter, the S&P 500 is down (so far—as of market close noonish last Monday) 17.1%.

Notice that recovery magnitude. Things get better both economically—and politically because good economics leads to good political outcomes for the party in power.

Update: Disregard yesterday, though; that was an aberration, not anything related to the Tables’ historical predictions. Harken to the trends, not the individual incidents.