Here’s one more argument for a flat, no deduction, credit, subsidy, etc tax code. Using the structure as a social or economic engineering tool just doesn’t work.

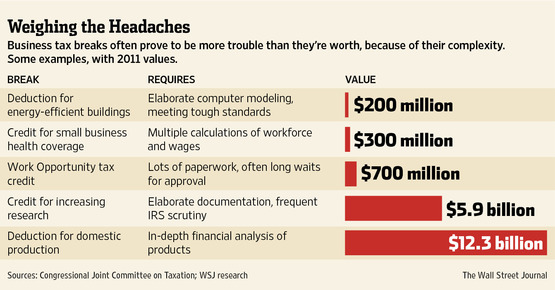

From John D McKinnon’s article in The Wall Street Journal at the above link comes this figure, showing the cost of meeting the requirements for getting Federal tax breaks generally, broken out by company size.

John Raine, CEO of Raine Inc., an Indiana manufacturer of belts and holsters for the military and other customers has an all too typical position about these “breaks.”

I usually avoid these targeted tax incentives, because it costs so much just to be compliant that it’s not worth messing with. I can’t run a business based on what area the federal government is trying to juice.

The Federal Work Opportunity credit is another example, and it, too, has a typical response. The Work Opportunity credit was designed to reward companies for hiring people from any of a number of disadvantaged categories of workers—welfare and food stamp recipients, youths seeking summer jobs, ex-felons, and the like. The credit is worth up to $2,400 per employee, and for businesses hiring unemployed veterans, it can be worth as much as $9,600 per.

The credit is too much trouble to collect, though. It requires extensive paperwork for each claimed worker, and incredibly, the paperwork can take a year or more to process. Assistant Professor of Economics at the University of Florida, Sarah Hamersma, has estimated that the credit is taken for only 20%-35% of all eligible workers.

McKinnon reports

JJ Pledger, Chief Financial Officer for the Twisted Root gourmet burger chain in the Dallas-Fort Worth area, said he spent the better part of a day last year trying to figure out how his company could obtain the credit. Mr Pledger, a CPA, knew the credit likely would be available for a number of his company’s 200 or so annual hires. But the more he read, “it seemed like the documentation of the tax credit could be really hard to administer,” he recalled. One concern was all the personal information needed from job applicants. “So I put it on the back burner….

There are other examples in McKinnon’s article.

Compliance costs for US businesses and individuals have reached 1% of GDP, roughly $150 billion last year. Out of 1.78 million US corporate tax returns, only about 20,000—just above 1%—claimed any of three dozen main business tax credits, the IRS estimates. This figure illustrates another aspect of the costs of these “breaks.”

It’s just too hard a thing to do to collect these, never mind the value.

I’ll say it again: flat tax. No deduction, no subsidy, no credit, no nothing. Say what your top line income was. Pay 10% of that. Be done with it, and all on Governor Rick Perry’s postcard.