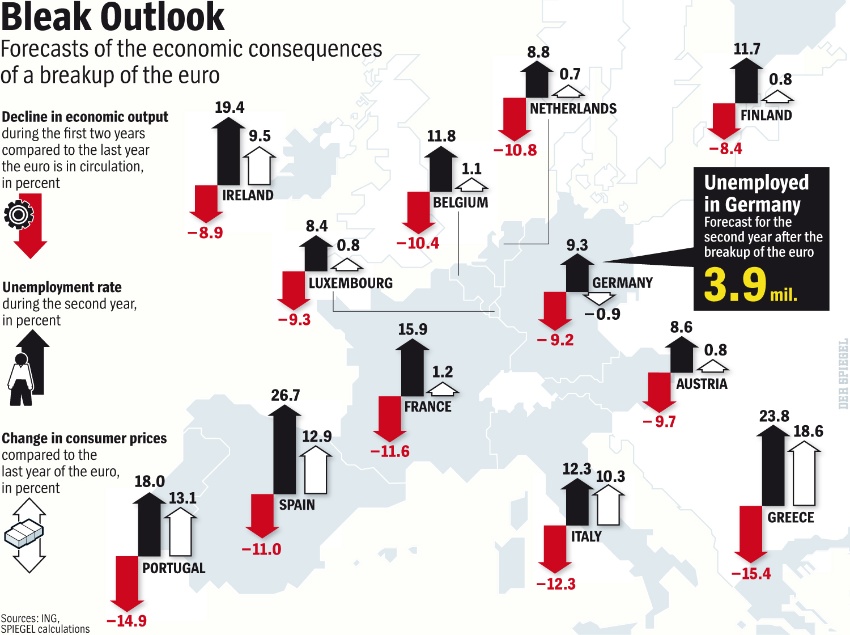

Much is being made of the impending collapse of the euro, and of the disaster this would represent for Europe. Indeed, a graph published by Spiegel Online can look frightening:

The risk to Germany in particular? Much is made about the money Germany and Germans have in some of the PIIGS, as the graph below indicates.

But against the German 2011 GDP of €2.57 trillion, this totals to less than 4%. That will sting, but not much.

As I’ve written before, a breakup would be near-term disruptive. But what happens after those two years of the first graph above? There needn’t be a disorderly collapse. Even this short term disruption (pop quiz: what are the current inflation and unemployment rates in the PIIGS?), the stronger economies will recover, and do so faster without the albatross of the profligate spend-and-borrowers dragging on their wallets. Furthermore, it’s not too late to realign into a small collection of smaller common currency regions, each with free trade agreements with the others. Within each smaller currency region, there would be a far larger opportunity for social, political, purpose-of-money homogeneity, and so a far greater chance of success.

The single alternative of every nation for itself with its old currency back is simply the other half of a false dichotomy presented by Spiegel Online—and by Europe’s politicians, who have a personal interest in the continuation of the current, failing, structure.