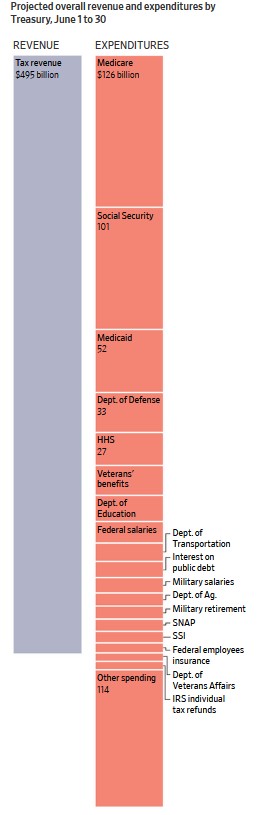

This one via The Wall Street Journal in an article positing three scenarios regarding our economy and the existing debt ceiling negotiations. The graph, which the WSJ sourced to the Bipartisan Policy Center, is especially dispositive given the backdrop of Progressive-Democrat President Joe Biden refusing to negotiate over an already House-passed bill that raises the ceiling along with some initial, and small, spending reforms. That backdrop also includes Biden’s, his Progressive-Democratic Party Congressional cronies’, and journalism’s shrill panic-mongering over default if the debt ceiling isn’t raised. Notice that. Interest on our nation’s debt is tiny compared with the revenue flowing in for June; that means there’ll be no default if Biden and his Treasury Secretary obey our Constitution, the latter which makes the situation plain in the Preamble to Article I, Section 8:

Notice that. Interest on our nation’s debt is tiny compared with the revenue flowing in for June; that means there’ll be no default if Biden and his Treasury Secretary obey our Constitution, the latter which makes the situation plain in the Preamble to Article I, Section 8:

The Congress shall have Power…to pay the Debts and provide for the common Defence and general Welfare of the United States….

There’s also plenty of revenue with which to make the scheduled principal payments on our debt. In addition to the lack of default, there’s provid[ing] for the common Defence: DoD, military salaries , and veterans’ benefits together, along with Homeland Security, are similarly tiny compared to the revenue coming in. Biden’s lies about cutting those veterans’ benefits in particular are exposed. Then there’s the general Welfare: these comprise the biggest share of that revenue—and there’s plenty of revenue with which to cover Medicare and Social Security as scheduled and with which to make the Medicaid transfers to the States.

The hard numbers will vary from month to month, but the revenues will be there to make the Constitutionally required payments.

What’s necessary to resolve the current situation are two things: Republicans need to stand firm on passing a debt ceiling increase only with spending reforms in order to reduce the need for future ceiling increases (along with, separately and subsequently, passing out of the House, where such things originate, a budget that reduces spending in the out years. There’s no need to wait for Biden’s foolishness of a sham budget proposal, ever), and for Biden and his Party cronies to get serious about negotiating specifics within that framework instead of blindly following an angry old man’s stubbornness.