The Wall Street Journal has an interesting piece comparing the People’s Republic of China’s economic future with India’s. In the second paragraph (the semi-lede?), there’s this:

The country’s population surpassed China’s last year. More than half of Indians are under 25.

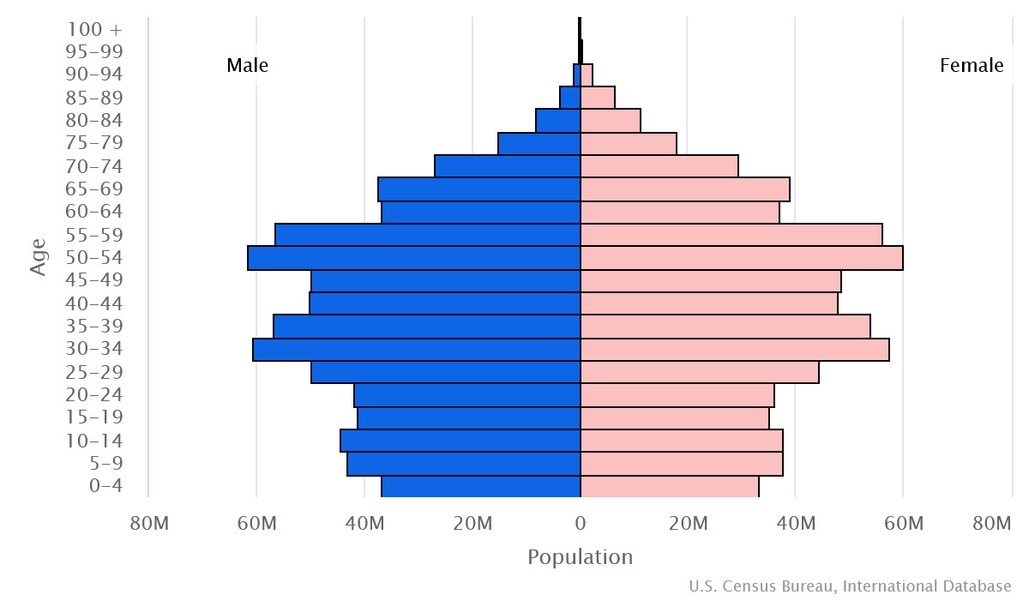

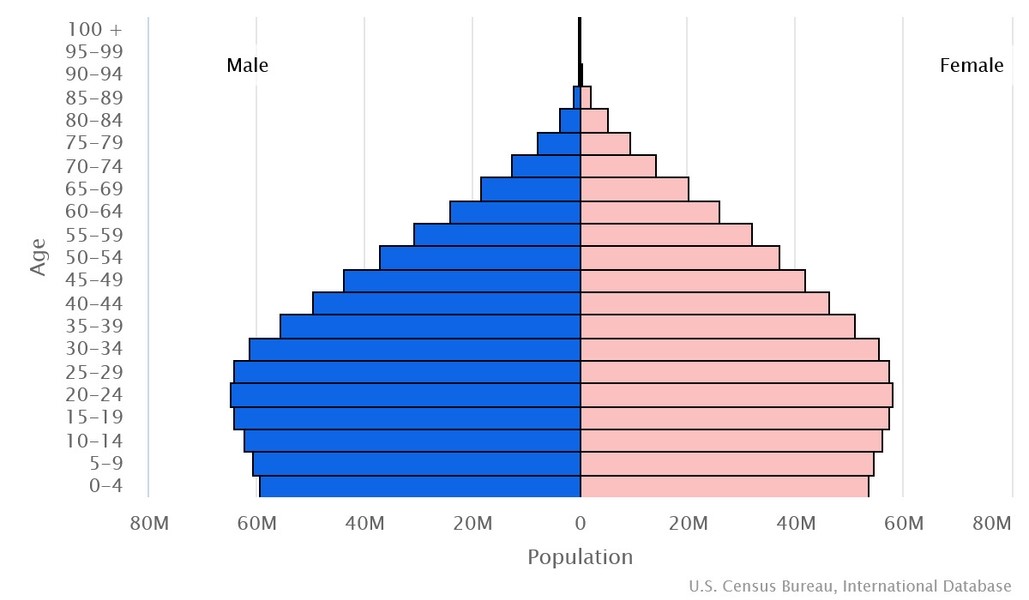

A couple of graphs from the CIA World Factbook put the two nation’s population structures in sharp relief, and at this stage of the two nations’ economic development, those structures are their future.

This is the structure of India’s population (scroll down a skosh):

This is the structure of the PRC’s population (again, scroll a tad):