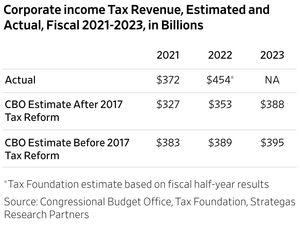

…must lead to Federal government tax revenue reductions. Or so Progressive-Democrats claim. Say it ain’t so, Joe. President Joe Biden (D) won’t say it, though, so I will. It ain’t so, as this table from The Wall Street Journal illustrates.

When you leave money in the hands of private economy operators—individual or corporate—they do productive things with their money. That productivity leads to more R&D, more innovation, more physical capital improvement, physical capital expansion, wage increases, more jobs (which represent the mothers of all wage increases, for many, from zero wage to an actual paycheck), the latter two leading to human capital improvement, which leads to greater private economy demand for goods and services, which leads to greater production of those goods and services, expanding the economic virtuous circle.

In comparison, Government merely redistributes from one operator—individual or corporate—to another its collected revenues, producing very little. Even the redistributions to noneconomic operators—individuals on welfare, for instance—the resulting production has less value than the transferred funds. The recipients of those redistributions have very small demand increases from the redistributions since they start out with small demands: they’re unemployed or employed only in low-wage, low-value jobs, and all those redistribution payments do is trap those folks in those two statuses.

All of that is even before any discussion of any need for the tax revenues Big Government Progressive-Democrats claim exists.

And government redistribution is less than complete (for the recipients) – it is subject to the friction of paying for all the government activity in the redistribution system, thereby reducing the actual amount passed on. It generates a net loss to the system.