Now the Obama administration wants to let the states charge tolls for the use of the Interstate highway system. This is the system for which our road and fuel taxes have already paid; the states’ tax money is supposed to be for maintenance and repair of the system.

OK, fair enough. Those roads won’t repair themselves.

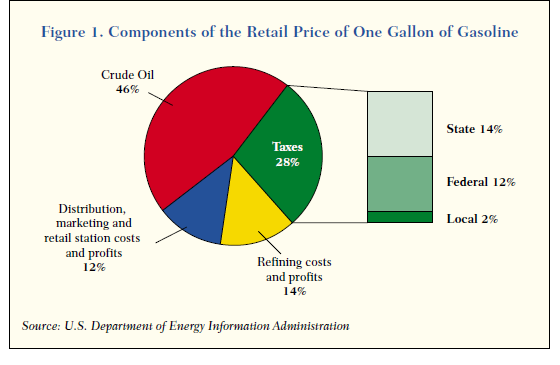

But we still pay those road and fuel taxes, and those funds are for maintenance and repair. This graph from the US Department of Energy, via the Center on Urban and Metropolitan Policy‘s Fueling Transportation Finance: A Primer on the Gas Tax, gives a breakout of what went into the price of a gallon of gas as recently as 2002.

Federal taxes were 12% of the price, or about 44¢ per gallon here in north Texas (updated to 2014).

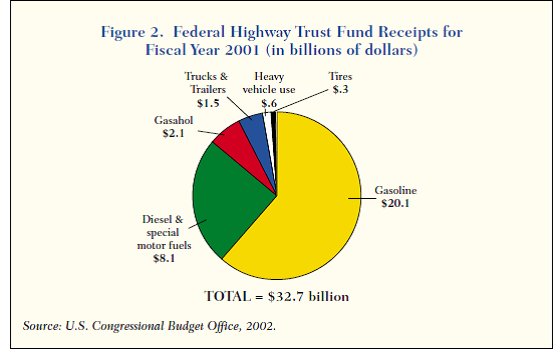

This graph, from the CBO via the same article, gives the 2001 breakout of Federal receipts for the highway trust fund.

Gasoline and diesel fuels—car and truck fuels—comprise the vast bulk of the receipts.

This 2007 table from the Federal highway administration updates those breakouts.

| Table 4. – User Fee Structure. | |

| Tax Type | Tax Rate |

| Gasoline and gasohol | 18.4 cents per gallon |

| Diesel | 24.4 cents per gallon |

| Special Fuels: | |

| General rate | 18.4 cents per gallon |

| Liquefied petroleum gas | 18.3 cents per gallon |

| Liquefied natural gas | 24.3 cents per gallon |

| M85 (from natural gas) | 9.25 cents per gallon |

| Compressed natural gas | 18.3 cents per 126.67 cubic feet |

| Tires: (maximum rated load capacity) | |

| 0-3,500 pounds | No Tax |

| Over 3,500 pounds | 9.45 cents per each 10 pounds in excess of 3,500 |

| Truck and Trailer Sales | 12 percent of retailer’s sales price for tractors and trucks over 33,000 pounds gross vehicle weight (GVW) and trailers over 26,000 pounds GVW |

| Heavy Vehicle Use | Annual tax: Trucks 55,000 pounds and over GVW, $100 plus $22 for each 1,000 pounds (or fraction thereof) in excess of 55,000 pounds (maximum tax of $550) |

Notice in the table that taxes are broken out, also, by vehicle weight. Trucks with tire capacity over 3,500 pounds are the trucks that ship our goods over the highways.

Cars and trucks—including those shippers—comprise the vast bulk of the Interstate highway users. Guess who’ll pay the tolls. And who’ll pay higher prices for the goods we buy after they’ve been shipped to the stores we frequent.

Will we see compensatory reduction in our fuel taxes, which as noted above already exist in major part to pay for interstate highway maintenance?

Fat chance.