At the start of the week, the Senate failed a cloture vote on President Obama’s Buffet Rule by a 51-45 vote, with Senator Susan Collins (R, ME) voting for on the excuse that the measure should be openly debated (never minding that President Obama has been debating it on his latest campaign tours), and Senator Mark Pryor (D, AR) voting against on the theory that such a measure should be part of a debate on general tax reform.

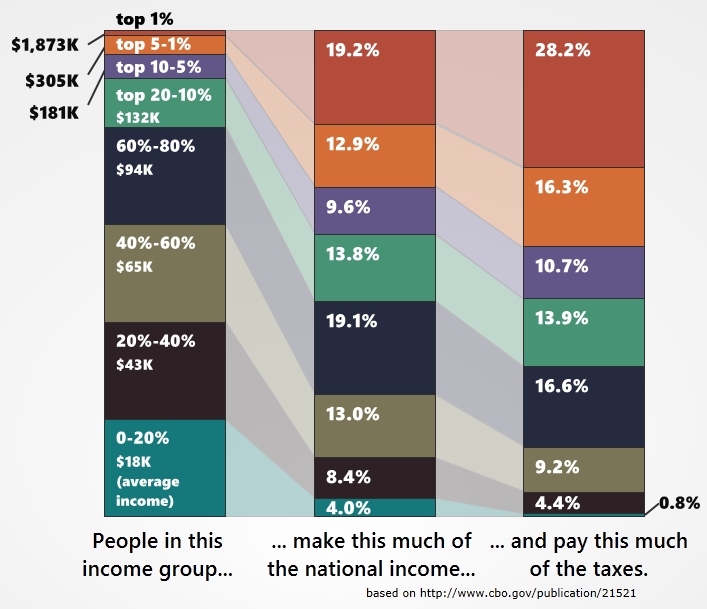

I won’t occupy bandwidth repeating commentary about Obama’s “it’s only fair” mantra. However, via Villainous Company, comes another view of what’s fair—the following graphic, based on tax rates from 2007 and published in 2010.

Interesting, this. The only folks paying roughly their “fair share,” if we’re willing to consider what’s fair to be paying a share of the nation’s income taxes roughly akin to the share of national income represented by one’s own income grouping, is those rich folks in the second 10% income group—those whose income puts them in the band of top 10% down to top 20% of income—and the truly destitute—those folks in the very bottom 20%. The Stinking Rich, those top 10%-ers, are paying far more than their fair share. And most everyone else below those top 20% are paying increasingly less than their fair share.

But President Obama and his Progressives want to pile on and make his ugly rich pay even further beyond their fair share. With lots of words about creating yet another entitlement program, a program of transferring tax money from those who pay a lot to those who pay a little. But with not a word about cutting spending to fit within the revenues already accruing to his administration. With not a word about reforming existing entitlements like Social Security, Medicaid, and Medicare.

Hmm….